Construction Insurance in Orange County: Complete Guide for Builders & Owners

Construction insurance Orange County is essential protection that shields builders, homeowners, and investors from the risk of losing millions. Whether you are planning a new custom home, a major renovation, or a large-scale commercial project in Orange County, having the right construction insurance Orange County coverage gives you peace of mind and financial security—no matter what unexpected event occurs. From natural disasters to accidents on-site, construction projects face numerous risks that can result in costly delays, legal liabilities, and financial devastation without proper insurance coverage.

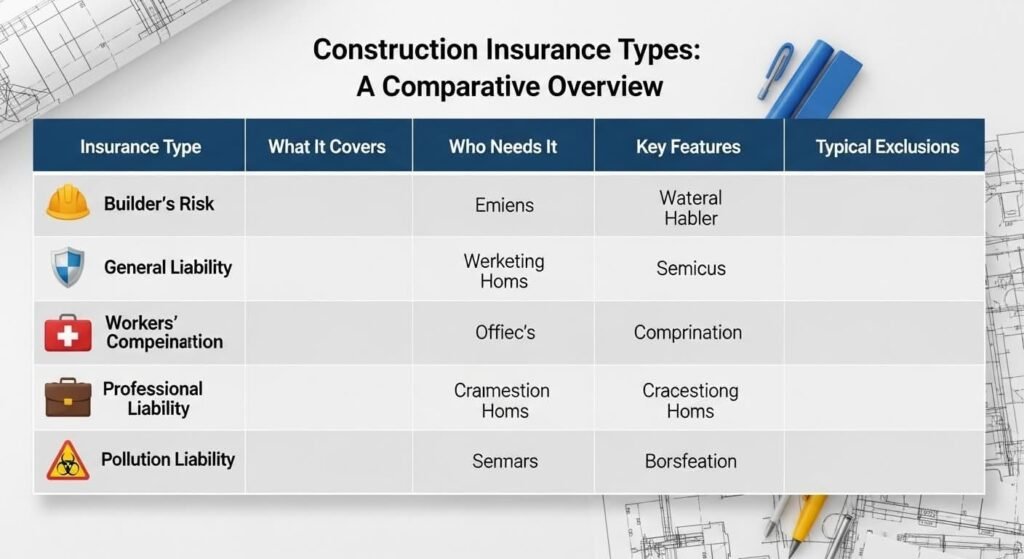

| Policy Type | Best For (OC) | Key Protection |

|---|---|---|

| Builder’s Risk | New builds, major remodels | Property/material damage during construction |

| General Liability | All OC projects | Injury claims, property damage to third parties |

| Workers Compensation | Any labor hired on-site | Worker injuries, site accidents |

| Professional Liability | Design, engineering, consulting | Design errors, negligence, advice mistakes |

| Pollution/Environmental | Demolition, large-scale builds | Pollution events, hazardous waste/spill cleanup |

Smart Insurance Checklist: What OC Owners Must Verify

- Check minimum required limits/sums for your project (often $1M+)

- Require the latest Certificate of Insurance with correct project info

- Check for “named” vs “blanket” coverage—prefer “blanket” for subs

- Carefully review exclusions: floods, earthquakes, major fires, etc.

- Insist on coverage for all subcontractors and extended parties

- Accurately declare equipment, materials, and total construction value

- Compare quotes from multiple providers to get the best rates

- Keep both scanned and hard copies of every insurance contract ready for dispute resolution

FAQ – Construction Insurance in Orange County

Q: What projects need construction insurance in Orange County?

A: Any new build, commercial project, or major remodel requires construction insurance in Orange County—protecting against shutdowns, lawsuits, and financial loss.

Q: How much does construction insurance in Orange County cost?

A: Residential policies typically range from $1,500 to $4,000, while large commercial builds may go $5,000+. Price depends on scope, project value, and coverage details.

Q: What happens if you skip construction insurance in Orange County?

A: Owners risk lawsuits, total loss of investment, construction stoppage, and may be barred from finalizing the project if an incident occurs.